Flexible income when you want it

Pension Drawdown

On this page

There are many ways to explain, yet it’s so easy to mis-understand

Pension drawdown is the main alternative to purchasing an annuity. It can be more suitable once you have enough secure income to pay for your essential lifestyle needs. Pension Drawdown, Income Withdrawal and Income Drawdown are ways of saying the same thing.

How it works

Not all pension providers allow the flexibility and choice across all the allowable rules. Many workplace pension schemes are restrictive. You can move your pension to another drawdown provider to benefit from a wider choice.

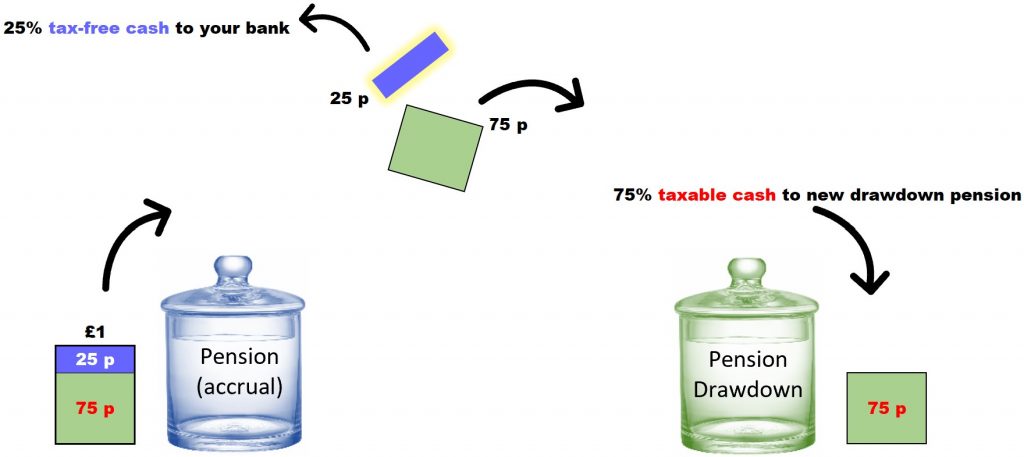

Here are two graphics, the first explains the concept, the second is an example. You might take all your tax-free cash, for good reason, but unless you need it, you don’t have to.

Before you take any benefits from your pension it’s referred to as an ‘Accrual‘ account, because it contains a lifetime of accruals from your contributions. It remains an accrual account until you draw income, when it normally becomes Flexi-access Drawdown. There some exceptions, and you should take advice.

Graphic 1

Before you take any income, each £1.00 in your pension is split - 75% taxable and 25% tax-free

When you ask for income, it triggers a process

Behind the scenes each £1 is treated separately. So, to draw 25% tax-free-cash, in this case 25p, you must move the whole £1 to a new drawdown account.

As it’s moved, the 25p splits away to your bank account. The 75% sent to your income account, there is no tax-free cash in this income account, so anything you draw is taxed as income.

Your Accrual fund still has your tax-free cash intact.

Both the Accrual and Income accounts maintain their tax efficient status.

Not all pension providers are as flexible as this and you might choose to move the pension to another provider, for a more flexible approach. But again, you should take advice before doing this.

Graphic 2

£200,000 pension fund showing a single £10,000 (5%) tax-free cash withdrawal

This works just like the first £1 example, but with more money and without withdrawing all the tax-free cash.

If all the tax-free cash were taken, the accrual fund would be empty. Although you can normally continue to pay money into that account and have 25% tax-free cash. * Subject to possible restrictions.

- £40,000 has to be moved to drawdown to extract £10,000 tax-free. This tax-free cash is split away to your bank and the remaining £30,000 goes to your drawdown income account.

- You can’t take the 25% out of your accrual pension without moving the other 75% to the Income account, because you can only take the tax-free cash from each £1.00 once.

* Your pension drawdown account it is subject to income tax once you draw income. Even the smallest withdrawal of income can seriously restrict tax relief on future pension contributions. Also bear in mind that legislation can quickly change.

Independent financial advice should be a prerequisite before using pension drawdown

The result

You now have two accounts:

- Pension Accrual Account with £160,000, 25% of which (£40,000) is still tax-free.

- Income Account of £30,000, which is taxable as income, but only on the money you withdraw. Both the drawdown and accrual money continue as tax efficient pension funds. You can withdraw money from your drawdown as regular income and it will be added to your other income for that year and taxed in the same way. Some pension providers allow single income payments, others limit your choices.

Phased Income Drawdown

Phased Drawdown is the name for a gradual withdrawal of income and tax-free cash. For example, you might use this to reduce your working hours to make up the loss and when you fully retire increase it to what you need.

Specialist calculators such as Income Planner will plan how many years your income can continue with this combination of tax-free cash and income. Financial advisers can do this, and some pension providers offer the facility. Both accounts are invested in the same funds you choose.

Drawdown providers vary, some are restrictive with limited choice and others offer real flexibility.

Income Tax

There are benefits to not taking all your tax-free cash at once, for example allowing you to spread the tax benefit over future years and reduce your taxable income. In these years your income would be part taxable and part tax-free. Your provider might be able to offer this service, but you should check.

More help

Pension Wise is a service from MoneyHelper, backed by government. Offering free, impartial guidance to over 50s.

Unbiased is an informative and independent website, this link takes you to their retirement section.

Looking ahead

Assume your pension fund has grown from £160,000 to £180,000 and the remaining tax-free cash that was £40,000 is now £45,000. It’s still in your accrual pension you have an extra £5,000 tax-free cash.

- You can continue to take part or all of your tax-free cash, without taking money from your taxable drawdown income account.

- You can choose to draw income as a combination of part tax-free cash and part taxable income, this can reduce your income tax in a year when you choose. In some instances, it could help keep your income within your personal allowance, or below higher rate tax bands.

The two kinds of drawdown

Since April 2015 new drawdown accounts have change to Flexi-Access Pension Drawdown, this has added more flexibility at retirement, which surprised everyone at the time because previous rules had always been quite restrictive, as in Capped Drawdown.

Capped Income Drawdown is when you have a pension prior to this date and moved it to drawdown, this can offer advantages as well as restrictions. If you are advised that you gain no advantage from retaining capped drawdown status, then you can normally switch to flexi-access drawdown.

Pension drawdown in particularly complex and requires financial advice, it’s too easy to make a mistake without it.

Planning your income withdrawal is a carefully prepared balancing act

Income Planner gives you peace of mind