The Cost of Retirement

Possibly your most important investment

Retirement, stopping work and living on what you’ve saved over all your years of hard work.

Income planner is just as important whether you are retired or just thinking about it.

On this page

Starting from scratch

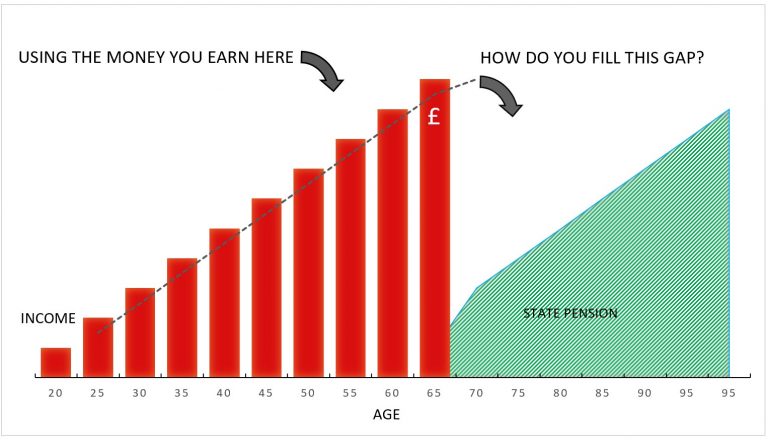

Your lifetime of work must pay for 30 years of spending

The size of the gap is different for everyone and you may not need to retire on 100% of your income.

The important thing is not to underestimate the size of this gap.

Try to live at least 15% below your income and invest the savings.

To check your State Pension Forecast,

follow this link to UK Government website

How much money do I need?

Just a rough guide

£100,000 in your pension could give you £3,500 per year from income drawdown.

£600,000 gives you £21,000 per year, plus a single maximum state pension the total is £29,000 to £32,000.

To pay you the equivalent of a full state pension of about £10,600 pa, you would need a savings investment of £385,000. The planner will give you a more a realistic picture of course.

How much should I save?

Suppose you are 43 and have 25 years to age 68, when your state pension is due.

If you saved £450 a month and already had £50,000, then at 68 you could have £400,000.

(Assuming 2.5% inflation and 3.5% growth).

If you were a couple with a full state pension each, it could last to age 90 paying an iannual income of £32,000, increasing by inflation.

This example might be you, if you’re starting off. The picture of the house is to highlight rental costs in retirement and the tremendous advantage of owning your own home when you do retire.

Quick way of working out how much you need

A rule of thumb

Say you have £100,000 and want to take £10,000 a year income. If the money stays in the bank with no interest, then it will only last for ten years. That’s the easy calculation.

But, if you invest this £100,000 and it grows exactly by inflation/rising prices, you can take £10,000 the first year and every year for nine more years. Your income will go up by inflation and the money will keep pace with rising prices, therefore it retains its buying power.

If it grows by less than inflation the income will buy less each year.

Or by more than inflation either the income will buy more, or you will have money left over at the end.

Consequently

However much money you have to draw income from, divide it by the number of years you want it to last. It's a rough and ready quick answer. (As long as it grows by inflation each year, it will retain buying power).

If you want £20,000 a year that keeps pace with inflation, £300,000 will last 15 years.

and for 30 years you need £600,000.

The higher your expectations, the more risk you must take chasing higher growth rates. Historically, a return equal to inflation averaged over 5 to 10 years has been achievable at relatively cautious risk.

Defined Benefit pension

Suppose you have a guaranteed final salary pension of £20,000 per year. How much would it be worth in cash, for example if you had to save up.

There is a standard calculation used to test these schemes against a SIPP for example. The conversion is to multiply the income by 20, so this would be valued at £400,000.